If you own a practice, the decision to sell, merge or bring on a new partner is one of the most significant financial milestones of your career. Without a precise medical practice valuation, you risk undervaluing years of hard work or setting unrealistic expectations that can derail negotiations.

Whether you’re planning for retirement, exploring a strategic merger or simply curious about your practice’s current market worth, understanding its value is essential. Consider this your guide to medical practice valuation, with insights into what buyers look for and how to prepare.

Understanding the fundamentals of practice valuation

At its core, a practice valuation is a systematic process that determines the economic worth of a medical practice. It goes beyond swiftly crunching numbers; it’s a comprehensive analysis of every aspect of your business, from tangible assets like medical equipment to brand reputation and patient loyalty.

You may decide to get a practice valuation for several key reasons:

- Selling your practice: an accurate valuation sets a realistic asking price and serves as a defensible starting point for negotiations.

- Mergers and acquisitions: when combining practices, a valuation ensures equitable terms for all parties involved.

- Bringing on partners: it helps determine a fair buy-in price for new partners joining your practice.

- Retirement and estate planning: a valuation is crucial for long-term financial planning.

- Securing financing: lenders often require a formal valuation to approve loans for expansion or equipment purchases.

To arrive at a final number, professional valuators typically use a combination of three primary methodologies:

The asset-based approach

The asset-based approach calculates the value of your practice by adding up all its assets and subtracting its liabilities. It focuses on your practice’s net worth as reflected on the balance sheet.

The valuator will take tangible assets, such as medical equipment, office furniture, computers and real estate into account. The value is often determined by their fair market value—what they could be sold for today—not their original purchase price or future depreciated value.

They’ll also add in your practice’s intangible assets, including established patient base, brand name and goodwill. Valuing these can be more subjective and often requires specialized assessment but is crucial for a complete picture.

The asset-based approach is often seen as a “floor” value for a practice. While straightforward, its main limitation is that it doesn’t fully capture a practice’s future earning potential, which is often the most valuable component.

The income-based approach

This approach focuses on your practice’s ability to generate future income. It’s one of the most common methods used for profitable medical practices because it directly reflects the financial return an owner can expect. Two primary techniques fall under this approach:

- Capitalization of earnings: this method takes your practice’s normalized historical earnings and applies a “capitalization rate” to convert that income stream into a present value. The capitalization rate reflects the risk associated with receiving those future earnings. A lower risk profile means a lower capitalization rate and a higher valuation.

- Discounted cash flow (DCF): the DCF method projects your practice’s future cash flow over several years and then discounts it back to a present-day value. This approach is more detailed, as it requires forecasting future performance and factoring in variables like growth rates and market changes.

The market-based approach

The market-based approach determines your practice’s value by comparing it to similar medical practices that have recently been sold. This is similar to how real estate agents use “comps” to price a house. The valuator looks for practices of a similar size, specialty and geographic location to establish a benchmark.

The primary challenge with this method is finding sufficient data on comparable sales. Private practice sales are not always publicly known, making it difficult to find true apples-to-apples comparisons. Additionally, differences in location, size and specialty can make reliable data challenging to find. When data is available, though, this approach can provide a powerful check on the values derived from the asset- and income-based methods.

A comprehensive business valuation for doctors often involves a blend of these three approaches. A professional appraiser will weigh the results of each to arrive at a single value.

The most important factors when valuing a practice

When a potential buyer or investor examines your practice, they are looking beyond the surface. They want to understand the underlying health and stability of the business. They’ll likely prioritize certain financial and operational metrics that offer the clearest window into your practice’s current performance and future potential. These can include:

Revenue streams and payer mix

A diverse and stable revenue stream is highly attractive to buyers. A practice that relies on a single service or a narrow payer mix is seen as riskier.

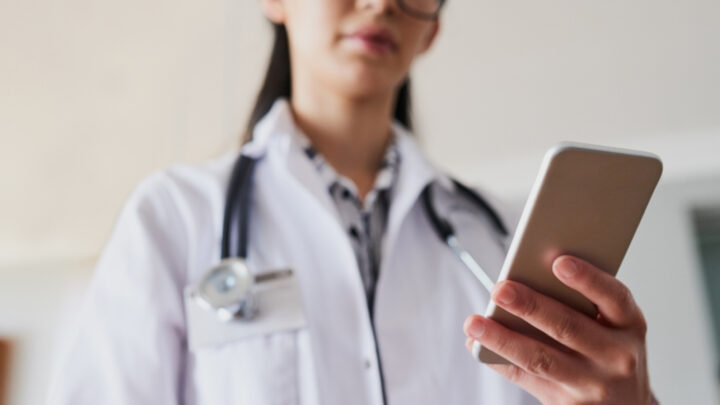

If you offer a range of services, that can be attractive to buyers. Ancillary services, such as in-house labs, imaging or physical therapy, can create additional revenue streams and make the practice more resilient. Offering services through telemedicine, which can create more avenues for revenue, can also be attractive.

Is your practice overly dependent on one insurance provider? A balanced mix of government payers (Medicare, Medicaid) and private insurers is ideal. A heavy reliance on a single payer can be a red flag, as a change in that relationship could severely impact revenue. In an internal poll of U.S.-based Sermo members, 31% of participants chose contracts and payer mix as one of the most important factors when valuing a medical practice (Note: respondents could choose more than one answer.)

Profitability and overhead

The most popular answer in the Sermo poll was revenue and profitability, selected by 62% of participants. High revenue with low profit margins is not a sustainable model. Buyers will scrutinize your practice’s income statement to assess its profitability, paying close attention to overhead expenses like costs for staff, rent, supplies and marketing.

They’ll look at your practice’s EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), a metric that’s widely used as an indicator of a company’s operational profitability. It removes the effects of financing and accounting decisions, allowing for a clearer comparison between different practices.

Accounts receivable (A/R)

Your accounts receivable represents the money owed to you for services already rendered. A well-managed A/R is a sign of an efficient billing and collection process. Valuators will age the A/R to see how long it takes to collect payments. A large percentage of receivables over 90 or 120 days old is concerning, as the likelihood of collecting that money from patients decreases over time. A clean and current A/R indicates strong operational management and healthy cash flow.

Cash flow

While related to profitability, cash flow is distinct. It is the actual cash moving in and out of your practice. A practice can be profitable on paper but have poor cash flow if it struggles to collect payments or has significant upfront expenses. Positive and predictable cash flow is essential for covering daily operating costs, investing in growth, and providing a return to the owner. Buyers look for a consistent history of strong cash flow as evidence that the business is financially stable.

Additional factors that can affect valuation

While the above metrics are arguably most important, they don’t tell the whole story. Several non-financial factors can also impact your practice’s final worth. These elements reflect the practice’s operational strength, market position and future growth potential.

Staff expertise and retention

A medical practice is only as good as its people. A skilled, experienced, and loyal team is an invaluable asset. High staff turnover can be a major red flag for buyers, as it suggests underlying issues with management, culture or compensation. Practices that lack human resource departments — a growing problem — don’t operate as efficiently. Conversely, a long-tenured team indicates a stable and positive work environment. In the internal poll on Sermo, participants selected what they consider to be the most overlooked factors when valuing a practice. Staff quality and turnover risk came in the lead with 57% of votes (note: members could choose multiple answers).

Patient demographics and loyalty

A large and loyal patient base is the lifeblood of any practice. Valuators will analyze patient demographics. A younger patient base suggests more long-term revenue potential, while an older demographic might have more immediate healthcare needs. They’ll also look at retention rates, as it’s more cost-effective to retain existing patients than acquire new ones.

Valuators may look at referral sources. A steady stream of referrals from other physicians is a strong indicator of a good reputation within the medical community.

Digital infrastructure and technology

Modern medical practices run on technology. An outdated IT infrastructure can be a significant liability, requiring a substantial investment from a new owner. Is the EHR system modern, user-friendly and compliant with current regulations? Migrating to a new EHR is a costly and disruptive process, so a well-functioning system is a major plus. Additionally, a practice with a robust telehealth platform is better positioned for the future.

Your online presence can pay off. A professional website, active social media profiles and positive online reviews contribute to the practice’s brand and ability to attract new patients.

Brand reputation and goodwill

Goodwill represents your practice’s reputation in your community. While difficult to quantify, goodwill is a powerful driver of value. It’s what makes patients choose your practice over a competitor and what encourages other doctors to send you referrals. A strong brand reputation can justify a higher valuation multiple because it directly translates to sustained patient flow. 40% of respondents in the Sermo poll consider reputation in the community as one of the most overlooked factors when valuing a practice.

The role of professional experts in the valuation process

While you’ve read a solid overview of how to value a medical practice, the process itself is complex and nuanced. Attempting a do-it-yourself valuation can lead to costly errors, whether you’re undervaluing your life’s work or overpricing it to the point of scaring away serious buyers. That’s why you may want to consider calling on professional help.

Engaging a Certified Public Accountant (CPA) with a specialization in healthcare or a dedicated professional valuation firm is worthwhile. The benefits of hiring a professional valuator include:

- Accuracy and objectivity: an independent expert provides an unbiased assessment, free from the emotional attachment you naturally have to your practice.

- Industry expertise: healthcare is a unique industry with its own set of rules, regulations and market dynamics. A valuator specializing in medical practices understands these nuances, from HIPAA compliance to reimbursement trends and physician compensation models.

- Defensible conclusion: a professional valuation report is a detailed, well-documented analysis that can withstand scrutiny from buyers, lenders and the IRS. This is crucial in negotiations and for legal or tax purposes.

- Access to data: professional firms have access to databases of comparable practice sales, which are essential for the market-based approach. They can come up with a more accurate benchmark than what is publicly available.

- Strategic guidance: beyond just providing a number, a good valuator can offer insights into what drives value in your practice and suggest improvements to enhance its worth before a sale.

Securing your financial future

A thorough valuation synthesizes hard numbers—like revenue and profitability—with the intangible strengths of your practice. By factoring in both, you gain a complete and accurate picture of your practice’s worth.

Accurate valuation requires a deep understanding of financial models, market trends and the healthcare industry. A CPA can help you achieve the best possible outcome.

As you navigate these complex business decisions, connecting with peers who have faced similar challenges can be invaluable. Sermo provides a unique community where you can get advice on topics like practice valuation. By joining, you can connect with more than a million of your peers worldwide and learn from their experiences.