What happens if you can’t pay your copay? When a patient cannot afford their copay, physicians face a complex dilemma balancing financial viability with ethical obligations. While policies vary by practice type, specialty, payer mix, and state law regulations, most physicians encounter this situation at some point—especially as high deductible health insurance plans and rising cost-sharing requirements become more common.

For many practices, patient copays represent a meaningful portion of overall revenue. At the same time, physicians are trained to prioritize patient well-being, continuity of care, and professional ethics. Navigating this tension requires more than a rigid policy; it requires clear communication, consistency, and an understanding of both legal boundaries and human realities.

Can a doctor refuse to treat a patient for non-payment?

Yes, in most non-emergency situations, a private practice physician can refuse to treat a patient who cannot pay their copay or outstanding balance. However, there are important exceptions and risks to consider.

Physicians and hospitals are bound by the Emergency Medical Treatment and Labor Act (EMTALA) to provide stabilizing care regardless of the patient’s ability to pay. If the patient is in an emergency condition or if a patient-doctor relationship has already been established and the patient is in a critical phase of treatment, refusing care could be considered patient abandonment. It is crucial to document all financial discussions and provide notice if discharging a patient from the practice. When terminating a patient relationship for financial reasons, best practice includes written notice, continued care for a reasonable transition period, and referrals when appropriate.

Navigating the copay conundrum

Regardless of a health plan type, most insured patients in the United States are responsible for a copay at the time of service. Yet the reality of collecting that payment is often more complicated than policy documents suggest. So what happens when the funds aren’t there?

For many physicians, this scenario places them in a difficult balancing act between legal obligations and patient care: between “the devil and the deep blue sea”, as one urologist on Sermo described it. On one hand, routinely waiving copays can be considered a contract violation with insurance payers or even fraud (specifically regarding Medicare/Medicaid anti-kickback statutes). On the other hand, rigid enforcement can disrupt care, damage trust, and create medico-legal risk if patients delay follow-up or worsen clinically.

Real perspectives from the Sermo medical community

A U.S.-based specialist in ophthalmology and genetics turned to the Sermo community with a difficult scenario: “If a new patient doesn’t want to pay the co-pay, [that] is an easy decision. The patient is not seen. [But] what if the patient pays the co-pay for the first visit but needs important follow-up and says they have no money for the co-pay until payday?”

The physician noted that rescheduling until payday felt risky from a malpractice standpoint, yet seeing the patient without payment often resulted in difficult collection efforts later.

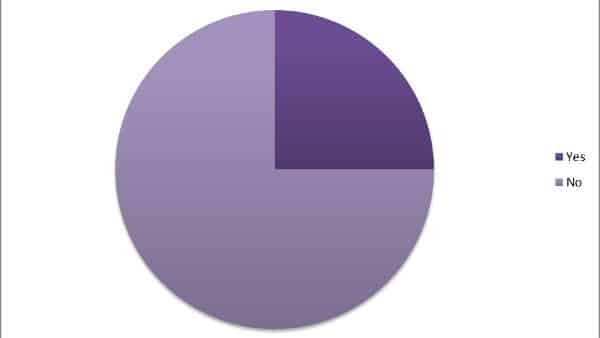

How physicians handle non-payment

Doctors across specialties on Sermo weighed in, revealing that while financial health is vital, patient health usually comes first.

- The “Compassionate Exception” Approach: Many doctors choose to see established patients despite missed payments, especially for urgent issues. This approach emphasizes continuity of care but relies on discretion rather than routine policy exceptions.

According to one anesthesiologist on Sermo: “If it’s urgent/emergent, you have no choice but to see the patient as you’ve established a patient-doctor relationship. You will be at risk of being blamed for abandonment if you refuse.”

- The “Write-Off” Reality: Some physicians accept that losses are part of the business. Per a family medicine doctor on Sermo, “You just have to hope that most patients pay. Let staff do the best collections they can… you will eke out a living somehow.”

While not ideal, this mindset reflects the reality of many primary care and community-based practices.

- The Assessment of Legitimacy: Some physicians described making judgment calls based on patient behavior and communication. Although subjective, this approach underscores the importance of trust and transparency.

“I appreciate the patients who at least apologize and promise to pay when they can. I never turn anyone away who seems legit,” shared one Ophthalmologist.

Best practices: how to collect money from patients without harming relationships

Collecting patient responsibility is a critical part of revenue cycle management, but it doesn’t have to come at the expense of the doctor-patient relationship. Here are some actionable strategies to improve collections:

1. Clear financial policies:

Have patients sign a financial responsibility agreement outlining copays, charges, and expectations for payment plans. Written policies reduce ambiguity and protect staff from conflict.

2. Verify insurance before the visit:

Whenever possible, confirm coverage, deductible, and copayment amounts in advance. Inform patients during appointment reminders so that payment expectations are not a surprise.

3. Offer payment plans:

For patients experiencing genuine financial hardship, offering structured payment plans allows flexibility without violating payer rules. Avoid any informal or undocumented arrangements.

4. Collect at check-in:

Collecting copays before the visit reduces unpaid medical bills and awkward follow-up conversations. Empower front-desk staff with training on how to discuss and collect payments confidently and compassionately.

5. Know the laws:

Understand federal EMTALA (Emergency Medical Treatment and Labor Act) requirements, state-law abandonment rules, and payer contract terms. When in doubt, consult legal or compliance counsel.

Educating patients about copays and financial responsibility

One of the most effective ways to avoid copay conflicts is to provide comprehensive and easy-to-understand patient education. Many patients genuinely do not understand how copays work, what their insurance covers, or why physicians are required to collect payment at the time of service.

Before the first patient visit, you can use patient appointment reminders, self-service portals, intake forms, and waiting room education materials to inform patients about what copays are, when they are due, and what your practice’s policies are. Using plain language, avoiding medical or legal jargon, and translating materials into common local languages can help to make your educational materials more effective for diverse patient populations.

Additionally, let patients know that if they are experiencing financial difficulty, they should speak with your or your staff early. This encourages transparency and allows practices to apply hardship policies appropriately and legally. When payment discussions are routine and respectful, patients are less likely to feel singled out or embarrassed.

Navigating copay challenges doesn’t have to be a solo effort

Copay challenges are rarely straightforward. They sit at the crossroads of patient care, legal compliance, financial sustainability, and professional ethics—often forcing physicians to make difficult decisions with incomplete information and real-world consequences. As rising deductibles shift more financial responsibility onto patients, these situations are becoming more common across specialties and practice settings.

What emerges clearly from physician experience is that there is no single “correct” response. Instead, successful approaches rely on clear policies, consistent documentation and thoughtful patient education. On Sermo, doctors regularly share real-world scenarios, practical strategies, and hard-earned lessons about handling copays, financial hardship, and patient communication. Join the physician community to add your voice to the discussion.

Frequently asked questions on communication. Join the physician community to add your voice to the discussion.

If a patient can’t pay their copay at check-in, consider the following steps:

Communicate Clearly: Politely inform the patient of the policy regarding copays.

Offer Solutions: Explore options such as payment plans or financial assistance programs.

Document the Situation: Keep a record of the conversation and the patient’s inability to pay.

Prioritize Care: If medically necessary, you may still see the patient and discuss payment options afterward.

Always ensure that your practice’s policy is in line with legal and ethical guidelines.

Waiving copays is not inherently illegal, but it can raise ethical and legal concerns, particularly regarding insurance fraud or billing practices. It’s essential to consult with legal or compliance experts to ensure that any waivers comply with applicable laws and regulations.

If you waive a copay due to verified financial hardship, document the situation in the patient’s record, including the reason for the waiver, any supporting documentation, and the date. Ensure the waiver is applied consistently and not used as a marketing tool. Proper documentation helps protect your practice from insurance or legal issues, especially with government-funded programs like Medicare or Medicaid.

Potentially, yes refusing care for non-payment can expose healthcare providers to malpractice risk. When a patient is in need of medical attention, refusing to provide care due to payment issues may be viewed as a failure to meet the standard of care, particularly in emergency situations. It’s important for healthcare providers to have clear policies in place regarding payment and to communicate those policies to patients. If a provider denies care and a patient suffers harm as a result, the provider could potentially face legal repercussions. It’s advisable for healthcare professionals to seek guidance on how to balance financial policies with their ethical and legal obligations to provide care.

High-deductible health plans have increased patient financial responsibility, making payment conversations more common. Practices may need stronger upfront education, more frequent payment plans, and improved cost transparency to adapt.High-deductible health plans have increased patient financial responsibility, making payment conversations more common. Practices may need stronger upfront education, more frequent payment plans, and improved cost transparency to adapt.High-deductible health plans have increased patient financial responsibility, making payment conversations more common. Practices may need stronger upfront education, more frequent payment plans, and improved cost transparency to adapt.

Whether having no copay is better depends on individual circumstances and healthcare needs. A plan with no copay typically means that you won’t have to pay a fee at the time of service for doctor visits or prescriptions, which can be financially advantageous, especially for those who require frequent medical care. However, these plans might have higher monthly premiums or deductibles. It’s essential to evaluate your healthcare usage, financial situation, and the overall costs of the plan, including monthly premiums, deductibles, and any out-of-pocket expenses, to determine what works best for you.

Generally, copays are set by insurance plans and are not negotiable. However, some providers may have discretion to offer discounts or payment plans if a patient experiences financial hardship. It’s best to discuss any concerns with your healthcare provider’s billing department to see if there are options available.